| ERR10010 |

İstekte zorunlu parametrelerden biri bulunamadı |

| ERR10011 |

Aynı parametre bir defadan fazla olarak gönderilmiş |

| ERR10012 |

Maksimum büyüklük değeri aşıldı |

| ERR10013 |

Geçersiz veri tipi |

| ERR10014 |

Geçersiz güvenlik algoritması |

| ERR10015 |

Geçersiz üye iş yeri bilgisi |

| ERR10016 |

Geçersiz tutar bilgisi |

| ERR10017 |

Geçersiz para birimi |

| ERR10018 |

Geçersiz dil seçimi |

| ERR10019 |

Genel hata |

| ERR10020 |

Geçersiz kullanıcı bilgileri |

| ERR10021 |

Boş parametre belirtilmiş, tüm parametreleri kontrol edin |

| ERR10022 |

Sipariş edilen ürünlerin toplam tutarı gerçek tutarla örtüşmüyor |

| ERR10023 |

Ödeme tutarı hesaplanan tutarla örtüşmüyor |

| ERR10024 |

Geçersiz vergi tutarı belirtilmiş |

| ERR10025 |

Belirtilen durumda vergi tutarı sıfır olmalıdır |

| ERR10026 |

Geçersiz entegrasyon modeli belirtilmiş |

| ERR10027 |

Geçersiz kart bilgisi (TOKEN) belirtilmiş |

| ERR10028 |

Belirtilen ödeme sistemi (sanal POS) bulunamadı |

| ERR10029 |

Belirtilen ödeme tipi (kampanya) bulunamadı |

| ERR10030 |

Belirtilen işlem bulunamadı |

| ERR10031 |

Bu işlem iade edilemez |

| ERR10032 |

Geçersiz iade tutarı belirtilmiş ya da bu işlem daha önce iade edilmiş |

| ERR10033 |

Bu işlem iptal edilemez |

| ERR10034 |

Belirtilen ödeme bulunamadı |

| ERR10035 |

Bu işlem için ön otorizasyon kaydı bulunmamaktadır |

| ERR10036 |

Tutar, orijinal istek tutarından daha büyük olamaz. |

| ERR10037 |

Belirtilen Kart Sahibi (Müşteri) kayıtlı değil |

| ERR10038 |

İlgili ödeme onay beklemektedir |

| ERR10039 |

Geçersiz ödeme durumu belirtilmiş |

| ERR10040 |

Geçersiz alt işlem (SUBACTION) belirtilmiş |

| ERR10041 |

Belirtilen kart daha önce eklenmiş |

| ERR10042 |

Kart daha önceden silinmiş |

| ERR10043 |

Geçersiz zaman aralığı belirtilmiş |

| ERR10044 |

Geçersiz tarih formatı belirtilmiş |

| ERR10045 |

Belirtilen kart numarası geçersizdir |

| ERR10046 |

Belirtilen kredi kartı geçerlilik tarihi geçersizdir |

| ERR10047 |

Kullanıcının API servislerini kullanma yetkisi bulunmamaktadır |

| ERR10048 |

Başarılı Bir İşlem zaten bu üye iş yeri sipariş numarası ile var |

| ERR10049 |

Ödeme, bu ödeme sistemi ile yapılamamaktadır. |

| ERR10050 |

Geçersiz HASH değeri |

| ERR10051 |

Herhangi bir ödeme sistemi (sanal pos) tanımı yok. Lütfen, kontrol ediniz. |

| ERR10052 |

Desteklenmeyen para birimi: |

| ERR10053 |

Kullanıcının bu üye iş yeri üzerinde işlem yapma yetkisi yok |

| ERR10054 |

Ödeme geçerlilik süresi maksimum limitin üstündedir. |

| ERR10055 |

Ödeme geçerlilik süresi minimum limitin altındadır. |

| ERR10056 |

Geçersiz API isteği belirtilmiş |

| ERR10057 |

Bayi Tipi sadece bir Ödeme Sistemi (Sanal POS) tipi ile ilişkilendirilebilir. |

| ERR10058 |

CARDTOKEN ve CURRENTCUSTOMERID parametreleri bir arada gönderilemez. |

| ERR10059 |

Bu müşteri no ile kayıtlı bir müşteri mevcuttur. |

| ERR10060 |

Geçersiz IP Adresi |

| ERR10062 |

Ondalık sayı parametresi sıfırdan küçük olamaz. |

| ERR10063 |

Üye işyeri ödeme sayfası ayarları zaten mevcut. |

| ERR10064 |

Üye işyeri ödeme sayfası ayarları bulunamadı. |

| ERR10065 |

Inconsistent installment information (KobiKart) |

| ERR10066 |

Belirtilen zaman bilgisi geçersiz ya da tutarsızdır |

| ERR10067 |

Invalid or Missing EXTRA parameter value |

| ERR10068 |

Geçersiz tekrar düzeni parametresi |

| ERR10069 |

Eşleniksiz iade sadece Finans ve İş Bankası ödeme sistemleri için desteklenmektedir. |

| ERR10070 |

Başlangı tarihi gelecekteki bir tarih olmalıdır |

| ERR10071 |

Geçersiz tekrarlı ödeme durum parametresi belirtilmiş |

| ERR10072 |

Harici iade, seçilen ödeme sistemi tarafından desteklenmemektedir |

| ERR10073 |

SaveCard ve ForceSave özellikleri bir arada kullanılamaz. |

| ERR10074 |

Bu müşteri no ile kayıtlı bir müşteri mevcuttur. |

| ERR10075 |

Üye iş yeri görsel (logo) bilgisi hatalı |

| ERR10076 |

Geçersiz tekrarlı ödeme durum parametresi |

| ERR10077 |

Geçersiz şablon |

| ERR10078 |

İşlem kilitlidir |

| ERR10079 |

Bu kart markasını destekleyen bir ödeme sistemi bulunmamaktadır. Lütfen başka kart markası ile tekrar deneyin. |

| ERR10080 |

Lütfen, Üye İş Yeri Sipariş numarasını veya Ödeme Oturumu(Token) veriniz |

| ERR10081 |

Geçersiz işlem durumu |

| ERR10082 |

API kullanıcısının bu işlem için yetkisi yoktur. |

| ERR10083 |

Geçersiz Statü |

| ERR10084 |

Faiz veya indirim oranı sıfır değeri olmalıdır |

| ERR10085 |

Başlangıç tarihi, bitiş tarihten daha büyük olamaz. |

| ERR10086 |

Geçerli bitiş tarihi şimdiki tarihten daha büyük olmalıdır |

| ERR10087 |

Taksit sayı numarası zaten bu ödeme sistemi ile bir ödeme tipi var |

| ERR10088 |

Geçersiz taksit sayısı |

| ERR10089 |

Geçersiz nonce |

| ERR10090 |

İşlem Başarısız |

| ERR10091 |

Ödeme sistemi devre dışı bırakıldığı için işlem gerçekleştiremiyor. Lütfen Üye İş Yeri Süper Yöneticisiyle iletişime geçiniz |

| ERR10092 |

Geçersiz Offset Değeri |

| ERR10093 |

Geçersiz Limit |

| ERR10094 |

Tanımlı bir kart bulunamadı. |

| ERR10095 |

Kayıtlı bulunan tekrarlayan ödeme planlarından dolayı kart silinemez. |

| ERR10096 |

Geçersiz oturum (session) bilgisi. |

| ERR10097 |

Sonlandırılmış oturum (session) bilgisi. |

| ERR10098 |

Bu oturum anahtarının yapılmak istenen işleme yetkisi yoktur. |

| ERR10099 |

Ödeme sisteminden alınan 3D cevabı değiştirilmiş veya yanlış 3D anahtarı |

| ERR10100 |

Bu ödeme için birden fazla başarılı işlem vardır, lütfen PGTRANID parametresini kullanınız. |

| ERR10101 |

Lütfen POST istegini method body içerisinde gönderiniz. Query String içerisinde gönderilen parametreler güvenli değildir. |

| ERR10102 |

Geçersiz BIN değeri |

| ERR10103 |

İşlem isteği Inact RT servisi tarafından raporlanan fraud olasılığı nedeniyle reddedilmiştir. |

| ERR10104 |

Geçersiz kart bilgisi |

| ERR10106 |

Bu işlem 3D doğrulama ile gerçekleştirilemiyor.

|

| ERR10107 |

Kullanilan ödeme sistemi kampanya kodunu desteklememektedir. |

| ERR10108 |

Puan kullanimi ödeme sistemi tarafindan desteklenmemektedir |

| ERR10109 |

This merchantpaymentId is used before and its session expired please use different merchantPaymentId |

| ERR10110 |

İstek ile mevcut sipariş numarasına ait oturumun tutar,kur,oturum tipi, url değeri ya da yapılmak istenen işlem değerlerinden biri uyuşmamaktadır |

| ERR10111 |

Puan sorgusu bu ödeme sistemi tarafından desteklenmemektedir |

| ERR10112 |

Puan json formatı geçersiz |

| ERR10113 |

Tekrarlı ödeme bulunamadı |

| ERR10114 |

Tekrarlı ödeme plan statüsü COMPLETED değiştirilemez |

| ERR10115 |

Tekrar sayısı 1 ile 99 arasında olmalıdır |

| ERR10116 |

Tekrarlı ödeme plan kodu mevcuttur |

| ERR10117 |

Ön otorizasyon yapan cüzdan oturumları sipariş numarası barındırmamalıdır |

| ERR10118 |

Geçersiz ticari kod parametresi |

| ERR10119 |

Ödeme sistemi puan parametresi hatalı, işlemin gönderileceği ödeme sisteminde gönderilen puan parametresi tanımlı değildir. |

| ERR10120 |

Puan değeri boş olamaz |

| ERR10121 |

Parçalı puan kullanımı bu ödeme sistemi tarafından desteklenmemektedir |

| ERR10122 |

3D doğrulama için Yasaklı BIN bilgileri |

| ERR10123 |

Aranan BKM İşlemi bulunamadı |

| ERR10124 |

Belirtilen tokena ait işlem bulundu. |

| ERR10125 |

İstenen işlem güncellenemez. |

| ERR10126 |

Payment System Type or EFT code is required if bin is not given |

| ERR10127 |

Geçersiz extra parametre değeri belirtilmiş |

| ERR10128 |

Tekrarlayan ödeme planı bir veya daha fazla işlenmiş işlem vardır bundan dolayı silinemez. |

| ERR10129 |

Ödeme Sistemi Güncelleme Edilemedi |

| ERR10130 |

Ödeme sistemi için verilen isim kullanımdadır |

| ERR10131 |

Ödeme sistem tipi mevcuttur |

| ERR10132 |

Bağlantı Hatası / Hatalı Veriler |

| ERR10133 |

Bu öğe kullanım dışı bırakılmıştır. Kullanım dışı bırakılmış öğeler güncellenemez. |

| ERR10134 |

Ödeme sistemi kullanım dışı olduğundan varsayılan olarak kabul edilemez. Lütfen önce etkinleştiriniz. |

| ERR10135 |

Varsayılan olarak işaretlenmiş bir ödeme sistemini kullanım dışı bırakamazsınız. Lütfen önce başka bir ödeme sistemini varsayılan olarak işaretleyiniz. |

| ERR10136 |

Uyumsuz İstek Parametresi |

| ERR10137 |

ÖDENMİŞ veya İPTAL EDİLMİŞ ödeme. |

| ERR10138 |

Müşteri bulunamadı |

| ERR10139 |

Kimlik numarası 11 rakam içermelidir |

| ERR10140 |

Kampanya sorgusu kullanılan ödeme sistemi tarafından desteklenmemektedir. |

| ERR10141 |

Geçersiz Etiketler Formatı. |

| ERR10142 |

Tekrar tutarlarının toplamı, tekrarlı ödeme planı toplam tutarına eşit değil. |

| ERR10143 |

Tekrarlı ödeme - kart ilişkisi bulunamadı |

| ERR10144 |

Geçersiz kampanya formatı. |

| ERR10145 |

Tekrarlayan Ödeme Durumu sadece Manually Paid güncellenebilir |

| ERR10146 |

Tekrarlayan Ödeme Durumu güncellenemez |

| ERR10147 |

Tekrarlayan Ödeme bulunamadı |

| ERR10148 |

Tekrarlayan plan durumu yalnızca Aktif veya Inaktif (Pasif) olabilir |

| ERR10149 |

Tekrarlanan Planın kartları yoksa aktif edilemez |

| ERR10150 |

Tekrarlı Ödeme Planı ya da herhangi bir Tekrarlı Ödeme bilgisini güncelleyebilmek için öncelikle Tekrarlı Ödeme Plan durumunu güncellemeniz gerekmektedir |

| ERR10151 |

İstek işlem kurallarına uygun değil. |

| ERR10152 |

Uygulanacak kart tipi seçimi yapılmalıdır |

| ERR10153 |

Tekrar tutarı sıfırdan büyük olmalıdır |

| ERR10154 |

Bu işlem 3D doğrulama kullanılmadan yapılamaz |

| ERR10155 |

Merchant can be enabled or disabled just by system users. |

| ERR10156 |

Belirtilen Ödeme Kuralı bulunamadı |

| ERR10157 |

Belirtilen bayi bulunamadı |

| ERR10158 |

Bu kod bilgisine sahip bir bayi hali hazırda bulunmaktadır. |

| ERR10159 |

Bayi deaktive durumdadir. Bu işlem yapılamaz. |

| ERR10160 |

üye iş yeri kullanıcısı bulunamadı. |

| ERR10161 |

Onay bekleyen bir işlem bulunmaktadır. |

| ERR10162 |

Sadece Satış Temsilcisi rolündeki kullanıcılar veya Bayi Süper kullanıcıları bayi ile ilişkilendirilebilir. |

| ERR10163 |

Geçersiz alt durum |

| ERR10164 |

Kullanıcının otomatik işlem yapma yetkisi yoktur. |

| ERR10165 |

Girdiğiniz bayi tipi adı önceden tanımlanmıştır. |

| ERR10166 |

Belirtilen bayi tipi bulunamadı |

| ERR10167 |

Bu bayi tipi tanımlı bir bayi tarafından kullanılmaktadır. Bayi ilişkisi kaldırılmadığı sürece silinemez |

| ERR10168 |

Bayi Ödeme Tipi belirtilen ödeme tipi ve bayi kodu ile bulunamamıştır. |

| ERR10169 |

Üye iş yeri e-posta adresi tanımlı. |

| ERR10170 |

Bayi ödeme tipi bu ödeme tipi ve bayi için tanımlıdır. |

| ERR10171 |

Bu ödeme sistemi belirtilen üye iş yeri için tanımlı değildir. |

| ERR10172 |

Üye iş yeri için belirtilen içerikte bir ödeme kuralı zaten mevcut. |

| ERR10173 |

Bu parametrenin değeri 0.00 ile 99.99 arasında bir değer olmalıdır. |

| ERR10174 |

Geçersiz işlem kuralları listesi |

| ERR10175 |

Bu ödeme için abonelikler boş olarak gönderilemez. Lütfen kontrol ediniz. |

| ERR10176 |

Üzgünüz, bu kullanıcıya ait rol bilgisini daha alt seviye bir rol olarak değiştiremezsiniz! |

| ERR10177 |

Kullanıcı güncellenemedi. |

| ERR10178 |

Yeni şifreleriniz birbirini tutmamaktadır. Lütfen yeni şifrenizi her iki alana da doğru olarak giriniz. |

| ERR10179 |

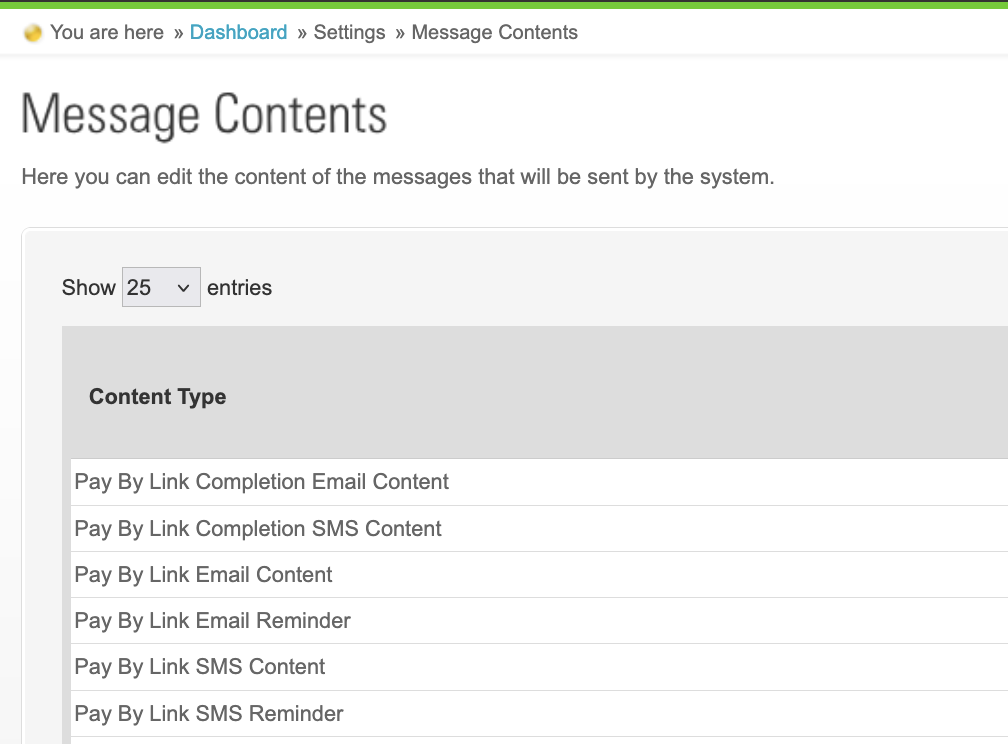

Mesaj içeriği bulunamadı |

| ERR10180 |

Şifreniz en az 1 büyük harf, 1 küçük harf, 1 sayı ve 1 sembol içermeli ve en az 12 karakter uzunluğunda olmalıdır. |

| ERR10181 |

Bu çağrı için PGTRANIDTOREFUND parametresi boş olamaz. |

| ERR10182 |

Bu tip ve dilde mesaj içeriği zaten mevcut. |

| ERR10183 |

Bu fatura bilgisi belirtilen bayi ve üye iş yeri için zaten var |

| ERR10184 |

Fatura bulunamadı |

| ERR10185 |

Bu fatura başarılı olarak ödenmiş, silinemez ve güncellenemez. |

| ERR10187 |

Faturalar sadece bayiler için tanımlanabilir. |

| ERR10188 |

Faturaya dair ödenecek tutardır, Orijinal tutardan fazla olamaz. |

| ERR10189 |

Fatura ödeme tarihi, fatura düzenlenme tarihinden daha sonra olmalıdır. |

| ERR10190 |

Ödeme Sistemi Kuralı Zaten Mevcut |

| ERR10191 |

Kullanıcı bulunamadı |

| ERR10192 |

Kullanıcı hesabı aktif değil |

| ERR10193 |

Kullanıcı hesabı kilitli |

| ERR10194 |

Şifreyi yeniden oluşturmak için token bilgisi yok ya da süresi dolmuş |

| ERR10195 |

Geçersiz kullanıcı adı ve/veya şifre |

| ERR10196 |

IP adresi sistemde tanımlı izin verilen IP adresleri listesinde bulunamadı |

| ERR10197 |

Bu kart zaten başka bir müşteri için kaydedildi. |

| ERR10198 |

Bu kart tipi eklenemez. Lütfen başka bir kart ekleyiniz. |

| ERR10199 |

İşlem tipi bu ödeme sistemi tarafından desteklenmiyor. |

| ERR10200 |

Beklenmedik ödeme sistemi entegrasyonu hatası |

| ERR10201 |

İletilen bayi ve/veya alt bayi kodu uyumlu değildir, lütfen kontrol ediniz. |

| ERR10202 |

VKN 9 rakam içermelidir. |

| ERR10203 |

ENDATE, STARTDATE'e eşit veya büyük olmalıdır. |

| ERR10204 |

Bu değerler ile Bayi Komisyon Oranı zaten mevcut. |

| ERR10205 |

Bayi Komisyon Oranı bulunamadı. |

| ERR10206 |

Kurallar yalnızca SubDealers için eklenebilir, Ana Bayiyi kontrol edin |

| ERR10207 |

Kurallar kodu çözülemez(decoded), kodlanmış RULE parametresini kontrol edin |

| ERR10208 |

Ana Bayı Kuralları aşıldı |

| ERR10209 |

Ticari kod için maksimum taksit sayısı aşıldı. |

| ERR10210 |

Varsayılan Alt bayi tipi silinemez. Lütfen öncelikle yeni bir Alt bayi tipi tanımlayınız. |

| ERR10211 |

Parçalı Ödeme Kodu Mevcut |

| ERR10212 |

Geçersiz Şehir ID |

| ERR10213 |

Lütfen bir varsayılan ödeme sistemi (sanal pos) olduğundan emin olun. |

| ERR10214 |

Üye İş Yeri için Ödeme Sistemi (VPOS) tipi ve adı mevcut |

| ERR10215 |

DEALERTYPENAME çoklu ödeme sistemi eklendiğinde kullanılır |

| ERR10216 |

Bilinmeyen CVV extra parametresi, parametre YES veya NO olabilir |

| ERR10217 |

Parçalı iptal işlemi bu ödeme sistemi tarafından desteklenmemektedir. |

| ERR10218 |

Parçalı iptal bu işlem tipi için desteklenmemektedir. |

| ERR10219 |

Geçersiz iptal tutarı |

| ERR10220 |

There is a active BIN rule with the same name |

| ERR10221 |

BIN rule not found for the merchant |

| ERR10222 |

Bu alanlardan biri sağlanmalı (Kart Ağı, Kart Tipi, Kart Markası, Ülke, Kart Bankası) |

| ERR10223 |

Bir BIN Kurali ile farkli isim, ancak aynı parametrelere zaten tanımlanmış |

| ERR10224 |

Maksimum taksit sayısı aşıldı. |

| ERR10225 |

Country Code ve Foreign parametreleri aynı anda gönderilemez. |

| ERR10226 |

Özel alan grubu bulunamadı |

| ERR10227 |

Aynı isimle özel alan grubu zaten mevcut |

| ERR10228 |

Özel Alan Geçerlilikleri Alanı Geçersiz |

| ERR10229 |

Özel alan zaten mevcut |

| ERR10230 |

Özel alan bulunamadı |

| ERR10231 |

Geçersiz Özelleştirilen Alan |

| ERR10232 |

Özelleştirilen Alan Zorunlu |

| ERR10233 |

Bu işlemi gerçekleştirmek için özelleştirilen alan yönetimi özelliği gereklidir. |

| ERR10234 |

Geçersiz kart hesap kesim günü |

| ERR10235 |

E-posta zaten sistemde başka bir kullanıcı için kayıtlıdır. |

| ERR10236 |

Ödeme Sistemi Kuralı Bulunamadı |

| ERR10237 |

İlişkili Ödeme Sistemi bulunamadı |

| ERR10238 |

Bu işlem için Ödeme Sistemi Paylaşım Yönetimi özelliğine sahip olmak gerekmektedir. |

| ERR10239 |

Geçersiz ayarlar parametresi |

| ERR10240 |

Mutabakat şeması mevcut değil |

| ERR10241 |

Mutabakat şeması zaten var |

| ERR10242 |

Kullanıcı tanımlı ya da aktif değil. Lütfen kullanıcı bilgisini kontrol edin. |

| ERR10243 |

USER parametresi sizin üye iş yeriniz icin kullanilamaz. |

| ERR10244 |

Belirtilen tarih aralığını kapsayan bir şema bulunmaktadır. Lütfen başka bir aralık giriniz. |

| ERR10245 |

Kullanımda olan mutabakat şemasını düzenleyemezsiniz. |

| ERR10246 |

CARDPAN hatalı format. |

| ERR10247 |

NAMEONCARD, CARDEXPIRY ve CARDPANCVV parametrelerini CARDPANTYPE parametresi ile aynı anda kullanamazsınız. |

| ERR10248 |

CARDPANTYPE parametresi CARDTOKEN parametresi ile aynı anda kullanamazsınız. |

| ERR10249 |

SAVECARD parametresini CARDPANTYPE parametresi ile aynı anda kullanamazsınız. |

| ERR10250 |

CARDPANTYPE parametresini INSURANCE olarak kullanma yetkiniz yok. |

| ERR10251 |

CARDPANTYPE parametresiyle 3D Satışa izin verilmiyor. |

| ERR10252 |

Satıcı banka başına birden fazla hesabı desteklemez |

| ERR10253 |

Aktivasyon tarihi bugünün gece yarısından büyük ya da eşit olmalıdır. |

| ERR10254 |

Bitiş tarihi bugünün gece yarısından büyük ya da eşit olmalıdır. |

| ERR10255 |

Bitiş tarihi aktivasyon tarihinden büyük olmalıdır. |

| ERR10256 |

Ön otorizasyon bu kart pan tipi için ödeme sistemi tarafından desteklenmemektedir. |

| ERR10257 |

Identity ve HostSubMerchantId parametreleri aynı anda kullanılamaz. |

| ERR10258 |

Idendity alanı 10 veya 11 hane olmalıdır. |

| ERR10259 |

Geçersiz Merchant Payment ID |

| ERR10260 |

Üye İş Yeri bu özelliği desteklemiyor. |

| ERR10261 |

Faturalarda ön kimlik kullanımına izin verilmiyor |

| ERR10262 |

INVOICEID'nin ön kimlik doğrulamalı faturalarla kullanılmasına izin verilmiyor |

| ERR10263 |

Üye İş Yeri Harici Kimlik Doğrulama seçeneğini desteklemiyor. |

| ERR10264 |

Harici kullanıcı, API Kullanıcısı olarak kullanılamaz. |

| ERR10265 |

Harici kullanıcı zaten var. |

| ERR10266 |

Harici kullanıcı mevcut değil. |

| ERR10267 |

Bu API Eylemi, Harici Kimlik Doğrulama seçeneğiyle kullanılamaz. |

| ERR10268 |

Bu konum kimliğine sahip konum zaten mevcut |

| ERR10269 |

ERR10269 |

| ERR10270 |

ERR10270 |

| ERR10271 |

Bu konum kimliğine sahip konum bulunamadı |

| ERR10272 |

Bu konum kimliğine ve bayi koduna sahip Bayi Konumu zaten mevcut |

| ERR10273 |

Bu konum kimliğine ve bayi koduna sahip Bayi Konumu bulunamadı |

| ERR10274 |

Bayi iş kolu zaten var |

| ERR10275 |

Bayi iş kolu mevcut değil |

| ERR10276 |

Uyumsuz MAC. |

| ERR10277 |

Fatura silinemedi |

| ERR10278 |

İptal edilen fatura ödemede kullanılamaz |

| ERR10279 |

Ödeme sistemi grup data bilgilerini sahip olmadığı için MERCHANTGROUPID parametresini kullanamazsınız. |

| ERR10280 |

Ödeme planı sorgusu ödeme sistemi tarafindan desteklenmemektedir. |

| ERR10281 |

Tanım ve Kimlik Vergi Numarası ekstra parametreleri gereklidir |

| ERR10282 |

ERR10282 |

| ERR10283 |

Ödeme tutarı, bu kullanıcı için izin verilen maksimum tutarı aşıyor |

| ERR10284 |

BIN bazlı kural sebebiyle ödemeye izin verilmedi |

| ERR10285 |

Kart kaydedilemedi. |

| ERR10286 |

Bu işlem için pgTranId parametresine izin verilmiyor. Lütfen bunun yerine MERCHANTPAYMENTID parametresini sağlayın. |

| ERR10287 |

İşleme izin verilmedi. Üye işyerinin seçilen ödeme sistemi için bir mütabakat şeması bulunmamaktadır. |

| ERR10288 |

Payment type maturity exist for this payment system with the additional maturity given |

| ERR10289 |

Additional maturity can not be bigger than maximum installment count |

| ERR10290 |

INVOICETYPE parametre değeri ile EXTRA'daki Preauth değeri uyuşmuyor |

| ERR10291 |

Tutar, acquire (kazanım) minimum tutardan düşük olmamalıdır. |

| ERR10292 |

JWT oluşturulamadı |

| ERR10293 |

Yabancı kart numarası ile işlem yapılamaz. |

| ERR10294 |

BIN kuralı tipi ile çoklu ödeme sistemi hesabı olan üye iş yeri için bir ödeme sistemi bulunamadı. |

| ERR10295 |

PAYMENTSYSTEMPOOL formatı hatalı. Lütfen doğru PAYMENTSYSTEMPOOL formatı gönderin. |

| ERR10296 |

Ödeme sistemi adı hatalı. Lütfen PAYMENTSYSTEMPOOL için doğru ödeme sistemi adı gönderin. |

| ERR10297 |

Ödeme sistemi aktif değil. Lütfen PAYMENTSYSTEMPOOL için aktif bir ödeme sistemi gönderin. |

| ERR10298 |

Birden fazla/az "varsayılan" ödeme sistemi gönderildi. Lütfen PAYMENTSYSTEMPOOL için bir tane "default" ödeme sistemi gönderin.

|

| ERR10299 |

Aynı bankaya ait birden fazla ödeme sistemi gönderilemez. Lütfen PAYMENTSYSTEMPOOL için aynı bankaya ait bir tane ödeme sistemi gönderin. |

| ERR10300 |

Girmiş olduğunuz kart bilgilerine ait (Vakıf Bank Tarım Kart) herhangi bir ödeme sistemi bulunamamıştır. Lütfen üye işyeri ile iletişime geçiniz. |

| ERR10301 |

Devam Eden bir İşlem zaten bu üye iş yeri sipariş numarası ile var |

| ERR10302 |

Kart Bilgileri Dogrula desteklememektedir. |

| ERR10303 |

Fiziksel Pos İşlemleri için PAYMENTSYSTEMTYPE desteklenmez |

| ERR10304 |

Kanal kodu panelde tanımlı değil. |

| ERR10305 |

Geçersiz Rol |

| ERR10306 |

ERR10306 |

| ERR10307 |

Ödemeyi bu kartla gerçkeleştiremezsiniz, lütfen başka bir kartla yeniden deneyiniz. |

| ERR10308 |

Bayi Kodu ve BNPL Ürün Kodu değerleri eşleşmemektedir. |

| ERR10309 |

Belirtilen ödeme yöntemiyle işlem yapma yetkiniz yok. |

| ERR10310 |

Veriler şifrelenemedi. |

| ERR10311 |

Komisyon şeması zaten var |

| ERR10312 |

Komisyon şeması mevcut değil. |

| ERR10313 |

Üye iş yeri özelliği bulunmamaktadır |

| ERR10314 |

Üye iş yeri istek hız limiti aşıldı. Lütfen daha sonra tekrar deneyin. |

| ERR10315 |

Session token ile yapılabilecek maksimum yeniden deneme sayısına ulaşıldı. |

| ERR10316 |

ERR10316 |

| ERR10317 |

E-Posta izin verilmiyor. |